Table of Contents

Introduction

Life is unpredictable, but your family’s financial security doesn’t have to be. Term life insurance offers a simple, affordable way to protect your loved ones from financial hardship if the unexpected happens. Whether you’re starting a family, buying a home, or planning for the future, understanding term life insurance is crucial for smart financial planning.

“Term life insurance can be a cost-effective solution for those seeking to protect their families without breaking the bank.”

— Mark Friedlander, Director of Corporate Communications, Insurance Information Institute (2023)[2]

What is Term Life Insurance?

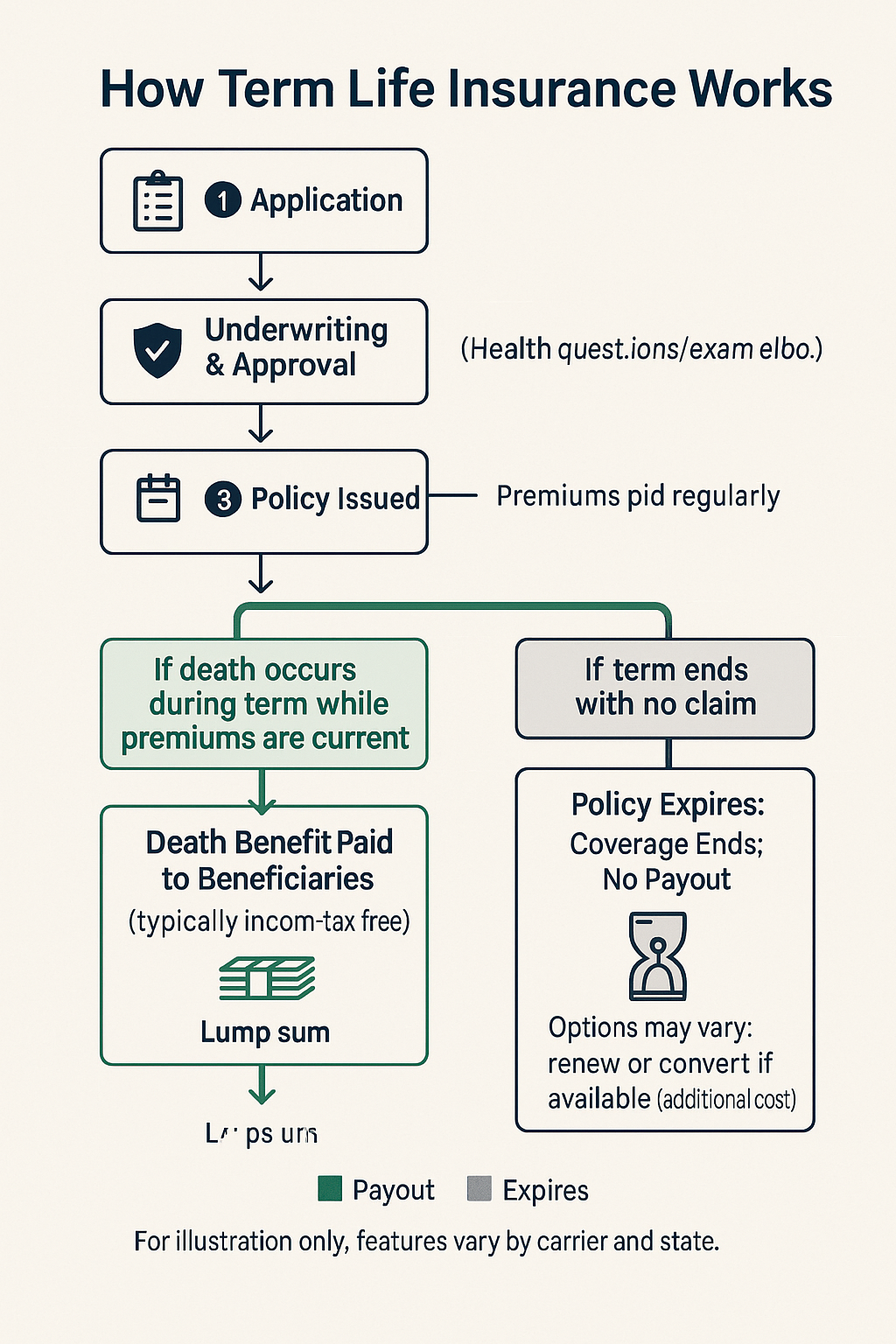

Term life insurance is a policy that provides coverage for a specific period—usually 10, 20, 30, or even 40 years. If the insured passes away during this term, beneficiaries receive a tax-free lump sum known as the death benefit[1][4]. If the policyholder outlives the term, no benefit is paid, and coverage ends unless renewed or converted.

-

- Temporary coverage: Designed for a set period (the “term”)

-

- Affordable premiums: Generally lower than permanent life insurance

-

- Pure protection: Pays only if the insured dies during the term—no cash value component

A Brief History of Term Life Insurance

The concept of term life insurance dates back to the 18th century, evolving as a straightforward way to provide pure risk coverage without a savings component[3]. Over time, it has become the most popular form of life insurance for income replacement and debt protection, especially among younger families and those with temporary financial obligations[3].

How Does Term Life Insurance Work?

When you purchase a term life policy, you agree to pay regular premiums for a set period. If you die within this term, your beneficiaries receive the agreed-upon death benefit. If you outlive the term, the policy expires, and no benefit is paid[2][4].

Example:

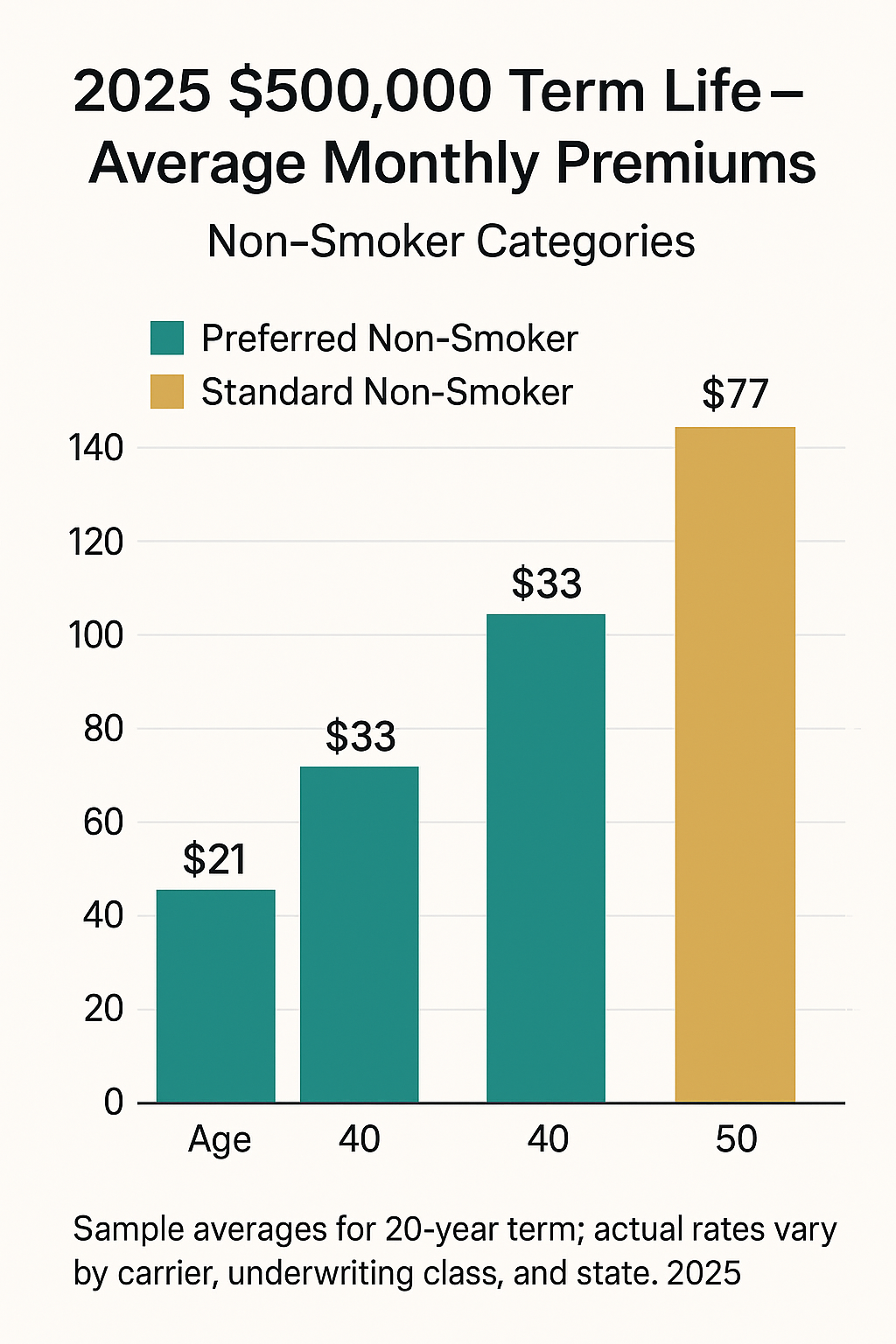

A healthy 30-year-old can buy a 20-year, $500,000 term life policy for as little as $25 per month in 2025, according to Protective Life[5].

-

- No cash value: Unlike whole life, you cannot borrow against or withdraw money from a term life policy[2].

-

- Level premiums: Most term policies have fixed premiums for the duration.

When is Term Life Insurance Most Beneficial?

Term life insurance is not one-size-fits-all. It shines in situations where protection is needed for a limited period.

Real-Life Scenarios

-

- Young Families:

Couples with young children can use term insurance to replace lost income and cover living expenses, education costs, and childcare in the event of a parent’s untimely death.

- Young Families:

-

- Mortgage Protection:

Homeowners often match the term of their policy to their mortgage payoff schedule, ensuring the home can be kept if something happens to the breadwinner.

- Mortgage Protection:

-

- Business Owners:

Term insurance can fund buy-sell agreements, settle business debts, or provide continuity if a key person passes away.

- Business Owners:

-

- Debt Coverage:

Individuals with large debts (student loans, credit cards) may use term insurance to prevent their obligations from burdening their families.

- Debt Coverage:

Case Study:

Jane and Mark, both 35, just bought a house with a 30-year mortgage and have two children under five. They purchase 30-year, $500,000 term policies. If either passes away before the mortgage is paid off, the surviving spouse can cover the loan and maintain the family’s lifestyle.

Key Takeaways: > – Term life is ideal for temporary, high-need periods. > – It’s a flexible, affordable tool for protecting families, assets, and businesses against loss of income or debt.

Term vs. Whole Life Insurance

Term and whole life insurance serve different needs. Here’s how they compare:

Comparison Table

| Feature | Term Life Insurance | Whole Life Insurance |

| Coverage Duration | Fixed term (10-40 years) | Lifetime |

| Premiums | Lower, fixed | Higher, fixed |

| Cash Value | None | Builds cash value |

| Payout | If death during term | Guaranteed (whenever death) |

| Policy Use | Income/debt protection | Wealth transfer, estate planning |

| Cost (2025 avg, age 30, $500k) | ~$25/month[5] | ~$400/month[2] |

| Flexibility | Can convert/renew | Less flexible |

Key Takeaways: > – Term is best for temporary, high coverage needs at low cost. > – Whole life is suited to lifelong protection and cash value accumulation.

Key Features and Benefits of Term Life Insurance

-

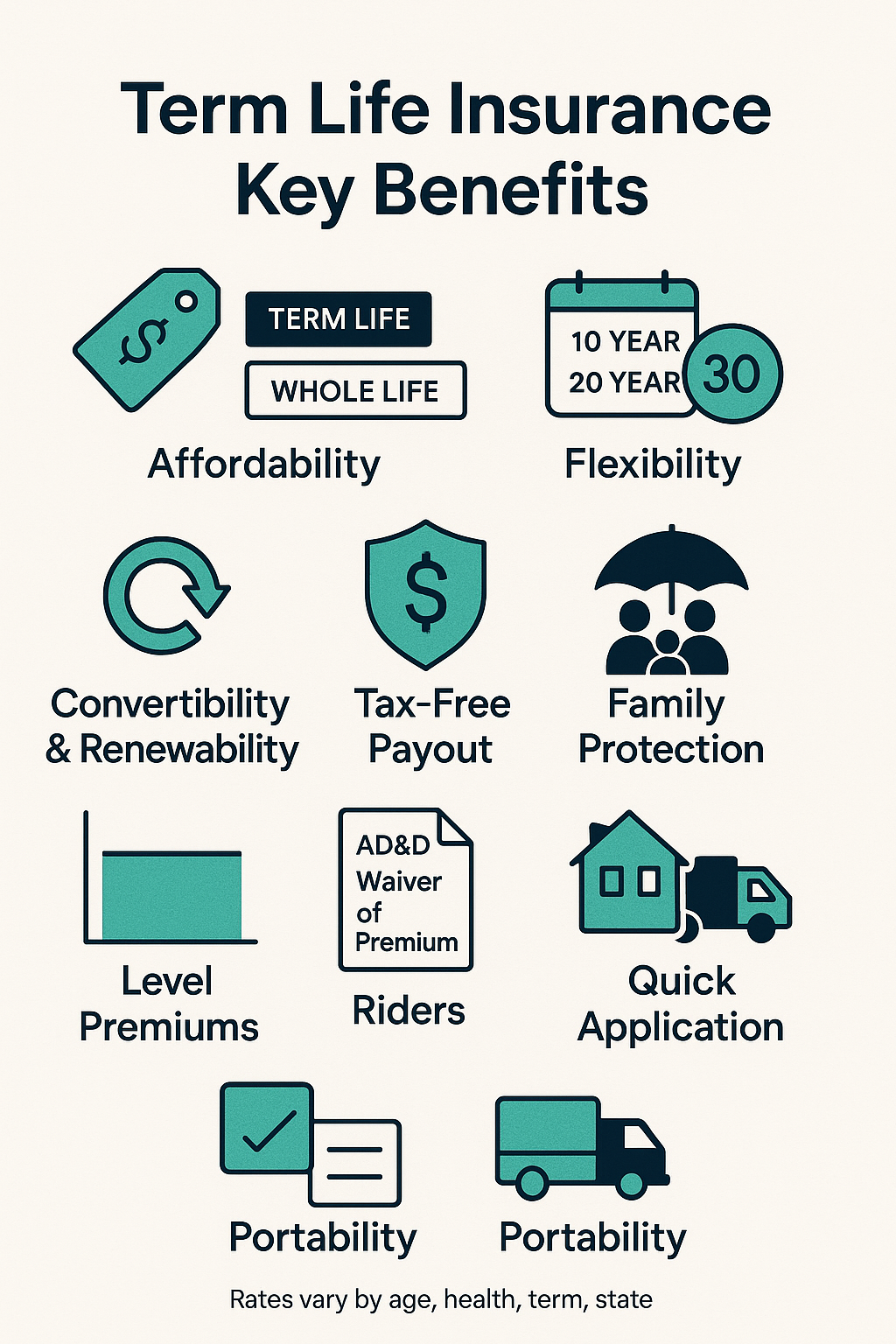

- Affordable premiums: Lower cost for higher coverage compared to permanent life insurance[1][5].

-

- Simple structure: Easy to understand and manage[4].

-

- Flexible terms: Choose coverage for 10, 15, 20, 25, 30, 35, or 40 years[4][5].

-

- Level premiums: Fixed payments for the duration of the policy[4].

-

- Conversion options: Many policies allow conversion to permanent insurance without a medical exam[5].

-

- Customization: Add riders for disability, chronic illness, or accelerated death benefits[5].

-

- Income tax-free payout: Death benefit is generally not taxed[5].

“Term life insurance is a straightforward, no-frills way to buy a large amount of coverage for a low price.”

— Jeanne Kane, CFP, JFL Total Wealth Management (2022)[2]

Policy Options, Term Lengths, and Customization

Term life insurance policies come in various term lengths to match your financial responsibilities:

-

- 10, 15, 20, 25, 30, 35, 40-year terms available from leading providers[4][5].

Customization Options: – Disability waiver of premium: Waives premiums if you become disabled. – Accelerated death benefit: Access a portion of the death benefit if diagnosed with a terminal illness. – Child or spouse riders: Add extra coverage for dependents.

“Many term life policies offer conversion privileges, allowing you to switch to a permanent policy without new underwriting.”

— Brian Ashe, Past Chair, Life and Health Insurance Foundation for Education (2021)[1]

Portability and Conversion Options

Portability:

Most term life policies are not portable between employers, but individually owned policies stay with you regardless of job change.

Conversion:

Many policies offer a conversion option, allowing you to convert your term policy to permanent life insurance—often without new medical exams—before your term ends[5].

Recent Trends and 2025 Market Rates

Trends in 2025: – Digital underwriting: Accelerated, no-exam applications via online platforms. – Expanded term lengths: More carriers now offer up to 40-year terms[4][5]. – Living benefits: Riders for chronic/terminal illness are increasingly standard[5].

Current Rates:

In 2025, average term life rates remain historically low due to increased competition and digital underwriting. For a healthy, non-smoking 30-year-old, a $500,000, 20-year policy averages $25–$30/month[5]. Rates increase with age and health risks.

Key Takeaways: > – Shop and compare, as rates are highly competitive in 2025. > – Look for policies with conversion and living benefit riders for added flexibility.

Expert Tips and Insights

-

- Match your term length to your longest financial obligation (e.g., mortgage, children’s education)[1].

-

- Review coverage needs every few years as life circumstances change.

-

- Consider conversion options if your health may decline.

Expert Quote: > “Choosing a term that matches your needs is critical; over-insuring wastes money, under-insuring leaves gaps.”

> — Marvin Feldman, President and CEO, Life Happens (2021)[2]

Pros and Cons of Term Life Insurance

Pros: – Lower premiums than permanent policies – Simple, predictable coverage – Flexible term lengths – Easy online application

Cons: – No cash value buildup – Coverage ends if you outlive the term – Renewal premiums can be high

Frequently Asked Questions (FAQ)

Q1: What happens if I outlive my term life policy?

A: The policy expires with no payout, unless you renew, extend, or convert your policy[2].

Q2: Can I convert my term policy to permanent life insurance?

A: Most policies allow conversion before the term ends, often without a medical exam[5].

Q3: Is the death benefit taxable?

A: No, the death benefit is generally income-tax free for beneficiaries[5].

Q4: How much term life insurance do I need?

A: Experts recommend coverage of 10–15 times your annual income, but use a calculator for personalized estimates.

Q5: What riders can I add to a term life policy?

A: Common riders include disability waiver, accelerated death benefit, and child/spouse coverage[5].

Interactive Tools

Term Life Insurance Calculator

Estimate your coverage needs:

Assessment Quiz: Is Term Life Insurance Right for You?

Quick Quiz: 1. Do you have dependents relying on your income? 2. Do you have a mortgage or significant debt? 3. Is your primary concern affordable, temporary protection? 4. Are you interested in building cash value, or just coverage? 5. Would you benefit from flexible riders (disability, living benefits)?

Result:

– Mostly “Yes”: Term life is likely a good fit.

– Mostly “No”: Consider permanent or other options.

Trust Signals, Testimonials, and Author Credentials

Testimonials: > “Purchasing term life insurance gave us peace of mind knowing our children’s future is secure even if we’re not around.”

> — Samantha R., Policyholder (2024)

Trust Badges and Resources:

– Insurance Information Institute – National Association of Insurance Commissioners – Life Happens

Author Credentials:

William Noel, author, and personal finance educator specializing in life insurance and family financial planning.

For more on related topics, visit:

– Life Insurance 101

– Financial Planning Strategies

– Whole Life vs. Term Life

Conclusion

Term life insurance remains one of the most effective tools for ensuring your loved ones’ financial security during critical life stages. By choosing the right coverage amount and term length, you can protect your family, safeguard your home, and provide peace of mind—all at an affordable price. Review your needs regularly, explore policy features and riders, and consult a certified professional to tailor a plan that fits your life.

References

[1]: New York Life

[2]: NerdWallet

[3]: Wikipedia: Term Life Insurance

[4]: Legal & General America

[5]: Protective Life

: MetLife