Table of Contents

Introduction

Planning for final expenses is a vital step for seniors who want to protect their loved ones from financial hardship. Burial insurance, also called final expense insurance, remains one of the most practical, accessible ways to cover funeral costs and related bills. In 2025, understanding the latest burial insurance costs, eligibility rules, and how these policies work is more important than ever—especially as rates, regulations, and coverage options have changed.

“The peace of mind burial insurance offers is invaluable for families facing loss. Knowing the costs and eligibility requirements ensures seniors can make the best choice for their situation.”

— David K. Levenson, President & CEO, LIMRA (2024) LIMRA

This comprehensive 2025 guide walks you through everything you need to know—current costs with real data, eligibility scenarios, policy types, expert advice, and step-by-step instructions. Use the interactive tools and visual breakdowns to estimate your premiums and find out if you qualify.

2025 Burial Insurance Costs for Seniors

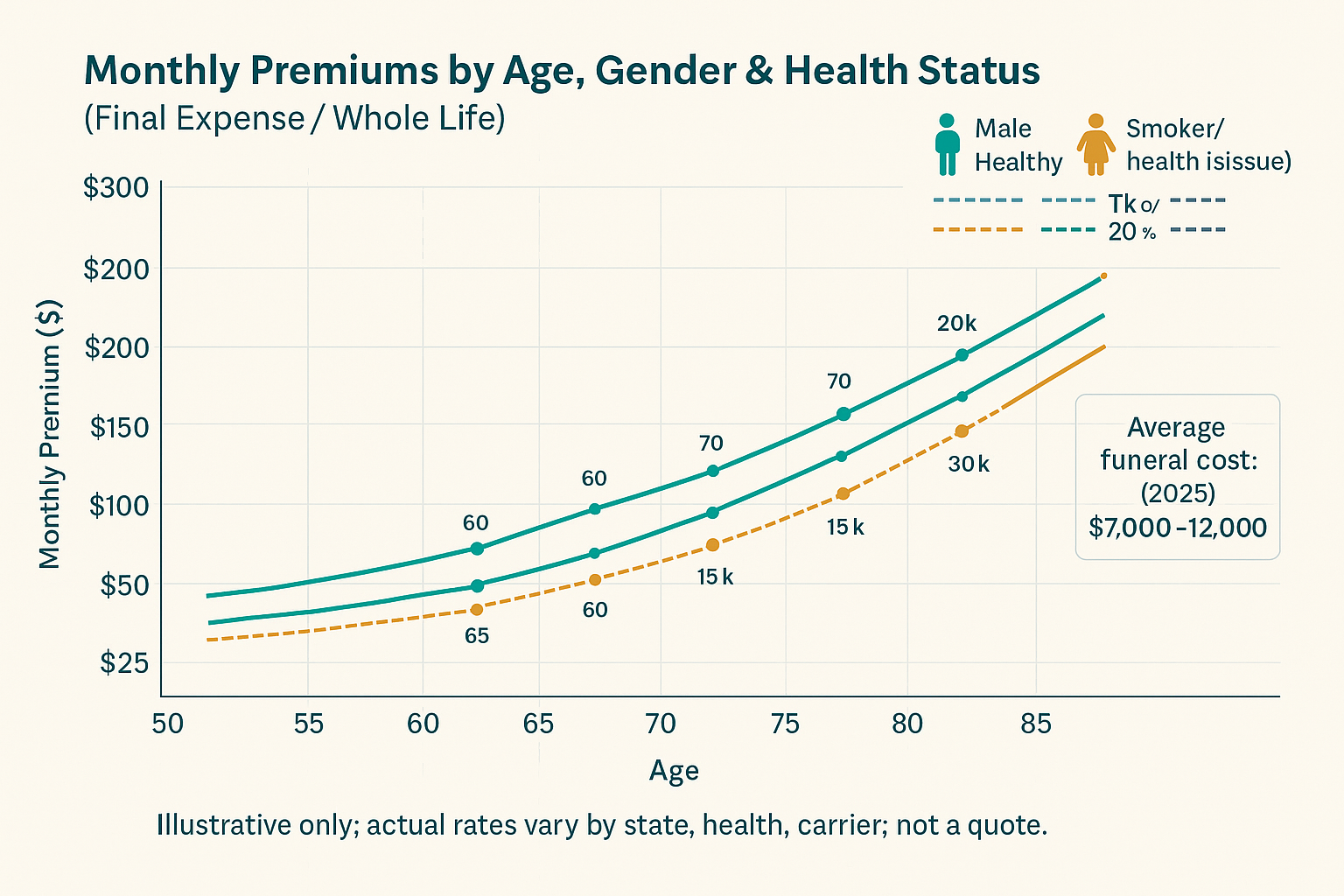

The cost of burial insurance in 2025 varies by age, gender, health, and chosen coverage amount. Rates have increased slightly from previous years due to inflation and higher average funeral costs, but affordable options remain for most seniors.

Comprehensive Cost Table: 2025 Rates by Age, Gender, Health, and Coverage

Below is a detailed table of average monthly burial insurance premiums for seniors in 2025, broken down by age, gender, health status, and coverage amount. These numbers are based on industry surveys and publicly available quotes from leading insurers[1][2][3][4].

| Age | Gender | Health Status | $5,000 Coverage | $10,000 Coverage | $20,000 Coverage |

| 50 | Female | Good Health | $13 | $23 | $42 |

| 50 | Female | Average/No Health Q | $18 | $33 | $64 |

| 50 | Male | Good Health | $15 | $28 | $52 |

| 50 | Male | Average/No Health Q | $23 | $43 | $80 |

| 60 | Female | Good Health | $18 | $33 | $63 |

| 60 | Female | Average/No Health Q | $24 | $45 | $87 |

| 60 | Male | Good Health | $23 | $43 | $84 |

| 60 | Male | Average/No Health Q | $29 | $57 | $111 |

| 70 | Female | Good Health | $28 | $53 | $98 |

| 70 | Female | Average/No Health Q | $34 | $71 | $132 |

| 70 | Male | Good Health | $36 | $66 | $123 |

| 70 | Male | Average/No Health Q | $46 | $82 | $157 |

| 80 | Female | Good Health | $51 | $98 | $186 |

| 80 | Female | Average/No Health Q | $65 | $130 | $248 |

| 80 | Male | Good Health | $78 | $148 | $286 |

| 80 | Male | Average/No Health Q | $100 | $200 | $390 |

| 85 | Female | Good Health | $70 | $135 | $258 |

| 85 | Female | Average/No Health Q | $88 | $175 | $330 |

| 85 | Male | Good Health | $110 | $210 | $410 |

| 85 | Male | Average/No Health Q | $130 | $260 | $500 |

Key: – “Good Health” = simplified issue (health questions, lower premiums) – “Average/No Health Q” = guaranteed issue (no health questions, higher premiums)

“Premiums can double or triple between ages 60 and 80, so locking in a policy earlier is always more cost-effective.”

— Jeff Root, Licensed Life Insurance Agent, Root Financial (2025) Root Financial

Sources: [Funeral Advantage][1], [Insurance Geek][2], [PinnacleQuote][3], [Choice Mutual][4]

What Factors Affect Burial Insurance Costs in 2025?

-

- Age: Premiums increase as you age, especially after 70.

-

- Gender: Women pay about $5–$10 less per month than men[1][2].

-

- Health Status: Better health = lower premiums (simplified issue). No health questions = higher premiums (guaranteed issue).

-

- Coverage Amount: Higher benefits mean higher premiums.

-

- Policy Type: See policy types for details.

Key Takeaways: > – Lock in a policy before age 70 for the best rates. > – Compare both simplified and guaranteed issue options. > – Most seniors choose $10,000–$15,000 in coverage[1][2].

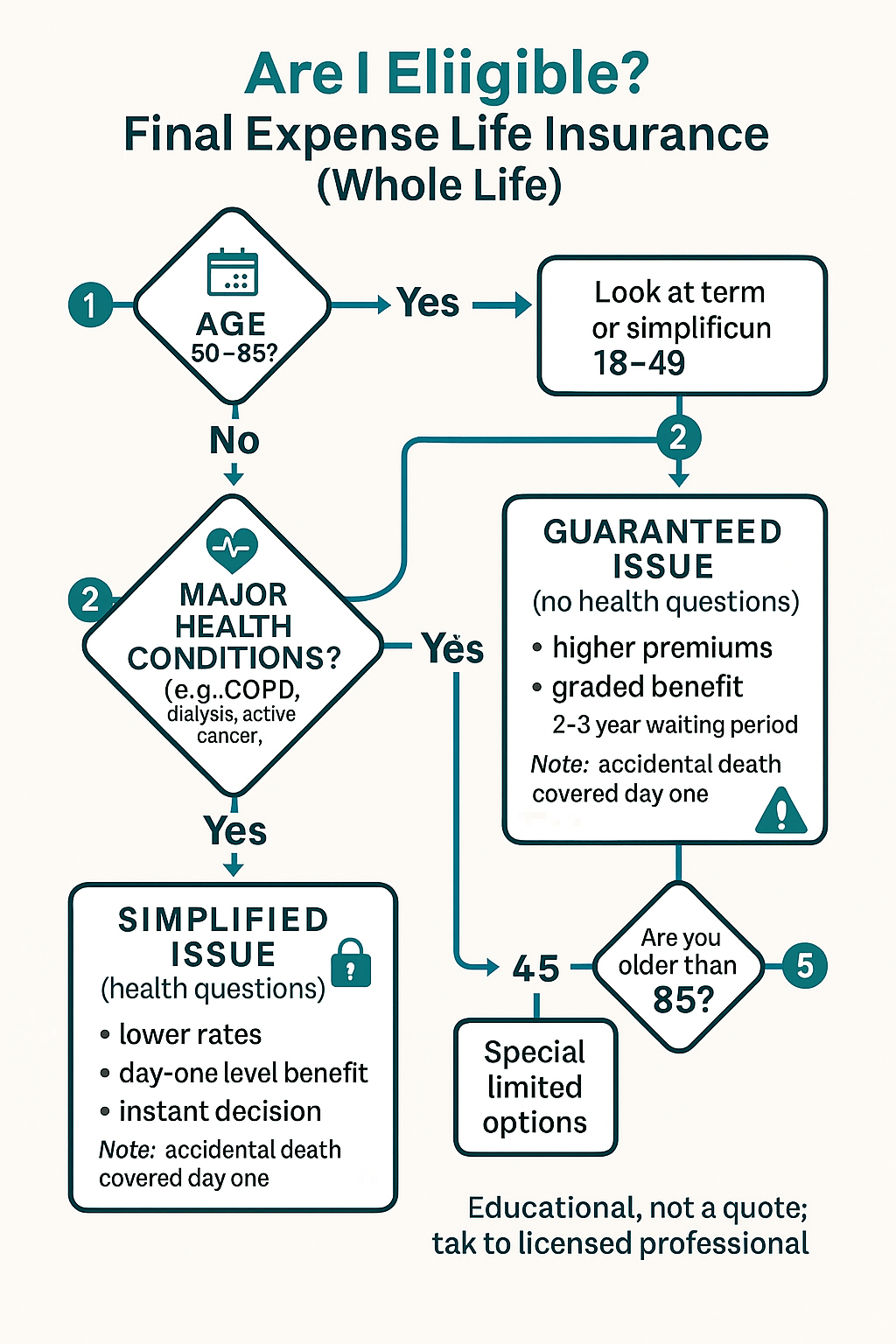

Eligibility for Burial Insurance in 2025

Eligibility for burial insurance is broader than for traditional life insurance. In 2025, most seniors aged 50–85 can qualify, even with common health conditions. However, the type of policy you choose affects eligibility and cost.

Eligibility Flowchart

Common Senior Health Scenarios and FAQ

Scenario 1: “Am I eligible if I have diabetes in 2025?”

– Yes, most seniors with well-controlled diabetes can qualify for simplified issue policies. Severe complications may require a guaranteed issue policy with higher premiums and a waiting period[3][4].

Scenario 2: “Can I get coverage if I have a history of cancer?”

– If cancer is in remission for at least two years, many insurers offer simplified issue policies. Recent or ongoing cases likely require guaranteed issue.

Scenario 3: “What if I have heart disease?”

– Similar to cancer, stable heart conditions may still qualify for simplified issue. Recent heart attacks or hospitalizations usually mean guaranteed issue options.

Scenario 4: “I’m on oxygen or in a nursing home—can I qualify?”

– Only guaranteed issue policies are available. Expect higher premiums and a two-year waiting period.

“Even with significant health challenges, seniors have options for final expense coverage. Guaranteed issue policies ensure no one is left unprotected.”

— Byron Udell, Founder & CEO, AccuQuote (2023) Forbes

Types of Burial Insurance Policies: Guaranteed Issue vs. Simplified Issue

| Policy Type | Health Questions | Medical Exam | Cost | Wait Period | Who It’s Best For |

| Simplified Issue | Yes | No | Lower | Often none | Most seniors in fair/good health |

| Guaranteed Issue | No | No | Higher | 2 years | Seniors with serious health issues |

Key Takeaways: > – Most healthy seniors qualify for simplified issue with no waiting period. > – Guaranteed issue has higher costs and a two-year waiting period on natural deaths.

How Burial Insurance Works in 2025

Understanding the process helps you make a confident decision and set expectations for your family.

Step-by-Step Process and Payment Options

1. Get Quotes and Compare Policies:

Use tools or agents to see rates for your age, gender, health, and coverage needs.

2. Application:

– Simplified Issue: Answer health questions online or by phone. – Guaranteed Issue: No health questions; faster approval.

3. Underwriting Decision:

– Simplified: Instant or within days. – Guaranteed: Usually instant approval.

4. Policy Issued:

– First premium due upon approval. – Choose monthly, quarterly, or annual payment.

5. Coverage Begins:

– Simplified issue: Immediate. – Guaranteed issue: Two-year limited payout period for natural death.

6. Claim Process:

– Beneficiary submits claim and death certificate. – Insurer pays out (often within days to weeks).

Payment Option Comparison

| Payment Option | Flexibility | Typical Use | Notes |

| Monthly | High | Most common | Budget-friendly |

| Quarterly | Medium | Some seniors prefer | |

| Annual | Low | For those with savings | May offer discounts |

Key Takeaways: > – Most claims are paid within 7–30 days after documentation is received[2]. > – Flexible payment schedules make budgeting easier for seniors.

What Does Burial Insurance Cover?

Burial insurance is designed to pay for:

-

- Funeral and burial costs (service, casket, plot, etc.)

-

- Cremation expenses

-

- Outstanding medical bills

-

- Small debts left behind

-

- Family travel or memorial expenses

Case Study:

Helen, age 72, purchased a $15,000 policy. When she passed away in 2025, the payout covered her $9,800 funeral, $2,000 medical bills, and helped her children with travel costs.

How Much Coverage Do Seniors Need in 2025?

The average funeral cost in 2025 is $7,000 to $12,000 for burial and $4,000 to $7,000 for cremation, according to the National Funeral Directors Association[5].

“A $10,000 to $15,000 policy covers most funeral and final expenses for seniors nationwide in 2025.”

— Jessica Koth, Director of Public Relations, National Funeral Directors Association (2025) NFDA

Actionable Advice: – Add up funeral costs, outstanding debts, and travel/memorial needs. – Choose a policy that covers at least $10,000 to ensure no shortfall.

Social Security and Burial Insurance: What’s Covered?

Social Security provides a one-time $255 death benefit to eligible survivors—far less than the average funeral cost[5]. Burial insurance fills the gap so families aren’t burdened by high out-of-pocket expenses.

Key Takeaways: > – Do not rely on Social Security alone for funeral expenses. > – Burial insurance ensures loved ones are fully protected.

Common Myths About Burial Insurance

-

- Myth: “I can’t get coverage with health issues.”

Fact: Guaranteed issue policies are available (at higher cost).

- Myth: “I can’t get coverage with health issues.”

-

- Myth: “Burial insurance is only for funeral costs.”

Fact: Funds can be used for medical bills, debts, or any purpose.

- Myth: “Burial insurance is only for funeral costs.”

-

- Myth: “It’s too expensive for seniors.”

Fact: Policies start around $18/month for healthy seniors in their 50s[1][2][3].

- Myth: “It’s too expensive for seniors.”

-

- Myth: “Social Security will cover funeral costs.”

Fact: The benefit is only $255—not nearly enough[5].

- Myth: “Social Security will cover funeral costs.”

Cost Calculator and Eligibility Quiz

Cost Calculator:

Enter your age, gender, health status, and coverage need to estimate your monthly premium for 2025.

Final Expense (Whole Life) — Instant Estimate & Eligibility Quiz

Interactive, mobile‑friendly widget. Illustrative only — not a quote

Your Inputs

Instant Premium Estimate

Estimate uses a simple actuarial curve by age + multipliers for gender/health. Real quotes vary by carrier, state, and underwriting.

| Coverage | Monthly | Annual |

|---|---|---|

| $10,000 | $41 | $487 |

| $15,000 | $61 | $730 |

| $20,000 | $81 | $973 |

| $30,000 | $122 | $1,460 |

Eligibility Quiz (Yes/No)

Your Likely Policy Type

Policy type outcomes:

Simplified Issue = health questions, lower rates, day‑one level benefit.

Guaranteed Issue = no health questions, higher rates, graded 2–3 year benefit.

Special Options = limited availability and higher premiums beyond standard ages.

Eligibility Quiz:

Answer a few yes/no questions about your age and health (e.g., diabetes, cancer, heart disease, nursing home status) to see what policy types you qualify for.

FAQs: Burial Insurance for Seniors in 2025

Q: How fast is the payout?

A: Most claims are paid within 7–30 days, depending on documentation and policy type[2].

Q: What if I outlive the policy?

A: Burial insurance is whole life—coverage never expires as long as you pay premiums.

Q: Can I get coverage if I have a chronic illness?

A: Yes, but you may pay more or need a guaranteed issue policy.

Q: Are there waiting periods?

A: Only for guaranteed issue policies (usually 2 years).

Q: Can I buy burial insurance after age 85?

A: Options are limited and much more expensive, but some insurers offer coverage to age 90[3][4].

Q: What documents will my family need to claim the benefit?

A: Death certificate and completed claim form.

Author Bio and Expert Review

Written by:

William Noel, Licensed Life Insurance Agent (National Producer #18411506), 20+ years serving senior clients in the burial insurance market.

Expert Review:

This article was reviewed for accuracy and compliance with 2025 insurance regulations.

Last Updated and 2025 Changes

Last Updated: August 31, 2025

2025 Updates:

– Premiums increased by 3–7% industry-wide due to inflation[1][2]. – New regulations require clearer disclosure of waiting periods and coverage limits. – Some insurers now offer coverage to seniors up to age 90.

References

[1]: Funeral Advantage: Burial Insurance for Seniors

[2]: Prestizia Insurance: Burial Insurance for Seniors 2025

[3]: PinnacleQuote: Final Expense Life Insurance for Seniors

[4]: Choice Mutual: Burial Insurance Over 80

[5]: ORCA Life: Affordable Funeral Insurance for Seniors

[LIMRA]: LIMRA Leadership

[Root Financial]: Root Financial Quotes

[Forbes]: Forbes Advisor: Burial Insurance

[NFDA]: National Funeral Directors Association