Table of Contents

Introduction

Whole life insurance is often marketed as a “set-it-and-forget-it” solution for lifelong financial security, promising guaranteed payouts, cash value growth, and even a tool for generational wealth. But behind the polished sales pitches, there are critical insider details, hidden costs, and real-world outcomes that policyholders rarely hear before signing up. If you’re considering whole life insurance—or already own a policy—this comprehensive guide reveals the full picture: benefits, drawbacks, and the secrets most agents won’t share.

“Americans spend more than $20 billion annually on whole life insurance premiums, but many don’t fully understand what they’re buying.”

— Mark Maurer, CFP, President & CEO, LLIS (2022)

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. Unlike term life insurance, which expires after a set period, whole life combines a guaranteed death benefit with a cash value savings component that grows tax-deferred.

Key features: – Level premiums: Premium amounts remain fixed for life. – Guaranteed death benefit: Pays out to beneficiaries no matter when you die. – Cash value accumulation: Part of your premium builds cash value, which can be borrowed against or withdrawn (with caveats).

Benefits of Whole Life Insurance

Living Benefits

-

- Guaranteed cash value growth: Every policy builds cash value annually, regardless of market performance.

-

- Policy loans: You can borrow against the cash value for emergencies, large purchases, or even investments—often without a credit check.

-

- Potential dividends: Participating policies may pay dividends, which can be used to buy more coverage, reduce premiums, or increase cash value.

Death Benefit Guarantees

-

- Permanent coverage: Unlike term life, your policy doesn’t expire as long as premiums are paid.

-

- Estate planning tool: Whole life is often used to transfer wealth tax-efficiently or to fund trusts for heirs.

-

- Living benefits in hardship: Some policies offer accelerated death benefits if you’re diagnosed with a terminal illness.

Key Takeaways: – Whole life is best for those who need lifelong coverage, want to build cash value, and can commit to higher premiums. – Dividends are not guaranteed and depend on the insurer’s performance.

Drawbacks of Whole Life Insurance

Cost and Complexity

-

- High premiums: Whole life can cost 5-15x more than term for the same death benefit.

-

- Long commitment: Policies require ongoing, often lifelong, premium payments. Missing payments can lead to policy lapse and loss of coverage/cash value[5].

-

- Complex design: Riders, dividends, and cash value features are often misunderstood.

Low Returns and Investment Alternatives

-

- Modest cash value returns: According to the [White Coat Investor][4], a recent policy for a 30-year-old guaranteed a return of only 2.18% after 29 years, with a projected return of 4.81%—lower than typical long-term stock/bond portfolios.

-

- Opportunity cost: Money locked into whole life can’t be used for higher-return investments or to max out retirement accounts.

Key Takeaways: – Whole life is expensive compared to term and may not be suitable for short-term needs or those seeking higher investment returns. – Policy loans and cash value access come with strings attached.

Insider Secrets: What Sales Agents Don’t Tell You

Hidden Fees and Policy Pitfalls

-

- Surrender charges: Early policy cancellations can trigger surrender fees, erasing much of the built-up cash value in the first 10-15 years.

-

- Commission structure: Agents may earn 50%–100% of first-year premiums as commissions, incentivizing sales over suitability.

-

- Modified Endowment Contract (MEC) risks: Overfunding policies can convert them to MECs, resulting in tax penalties for withdrawals[2].

Dividend Misrepresentation

-

- Dividends are not guaranteed: Agents sometimes project high historical dividends, but actual payouts are lower in today’s market[4].

-

- Illustration confusion: Sales illustrations may show “projected” returns far above current guarantees.

“Many consumers believe the dividend rate is the same as the return on their cash value, but this is not the case.”

— Jason Veirs, CFP, President, Insurance Experts Solutions (2023)

Borrowing Pitfalls

-

- High loan interest rates: Policy loans often charge 5-8% interest, and unpaid loans reduce the death benefit and cash value[1].

-

- Policy lapse risk: If loans plus accrued interest exceed the cash value, the policy can collapse, causing tax consequences.

“People are often surprised to learn that borrowing from their own policy isn’t ‘free money’—the interest can erode the benefit, and unpaid loans can even cause a policy to lapse.”

— John L. Olsen, CLU, ChFC, AEP, Olsen Financial Group (2021)

Policy Suitability

-

- Not all policies are needed: Many are sold to people better served by term life or other financial products[4].

-

- Suitability reviews are rarely performed by agents focused on commissions.

Key Takeaways: – Understand all fees, loan terms, and dividend projections before purchasing. – Ask for guaranteed vs. projected figures in writing.

Whole Life vs. Term Life: Head-to-Head Comparison

| Feature | Whole Life Insurance | Term Life Insurance |

| Duration | Lifetime (as long as premiums are paid) | Specific term (10, 20, 30 years) |

| Premiums | High, level for life | Low, level for term |

| Cash Value | Yes, grows over time | None |

| Dividends | Possible (not guaranteed) | None |

| Surrender Charges | Yes, if canceled early | None |

| Policy Loans | Yes, with interest | No |

| Commission Structure | High (often 50-100% first year) | Lower |

| Best For | Estate planning, lifelong needs | Income replacement, budget-conscious buyers |

| Insider Drawbacks | Hidden fees, low returns, loan pitfalls | May expire before you need it |

Key Takeaways: – Term life is best for most families seeking affordable, high coverage for a set period. – Whole life fits specific needs but requires careful scrutiny and long-term commitment.

Real-World Case Studies: Successes and Pitfalls

Positive Outcome: Leaving a Legacy

-

- Case: John & Jane (ages 60 and 53) borrowed from a $1M whole life policy (with $500,000 cash value, 6% loan rate) to buy a survivorship life policy. Their heirs received an extra $3M tax-free death benefit, illustrating how whole life can help with estate planning if managed correctly[1].

Negative Outcome: Policy Pitfalls

-

- Case: Chris & Deb (parents in their late 60s) signed a joint-life whole life policy with a $1M death benefit and annual premiums of $16,326, due to be paid until age 100. The ongoing high costs and lack of flexibility led to regret and a reevaluation of whether the policy made sense compared to alternatives[5].

Agent Tactics and Missteps

-

- Case: Corporate trustee and grantor owned two underperforming survivorship policies. Promised “vanishing premiums” did not materialize, forcing the grantor to take out loans to keep the policy active—jeopardizing both coverage and cash value. Only after renegotiations and policy replacements was a more sustainable solution found[2].

“I thought it was ridiculous we were wasting money on life insurance, being young and healthy, but I couldn’t have been more wrong.”

— Jeanie Kazemier, Life Happens Real Life Stories (2022)[3]

How to Evaluate Insurers and Policies

Not all insurers or policies are created equal. Here’s what to look for:

-

- Financial strength: Check ratings from A.M. Best, Standard & Poor’s, and Moody’s.

-

- Dividend history: Request the insurer’s actual dividend payout record for the last 10 years.

-

- Policy illustrations: Ask for both guaranteed and non-guaranteed projections.

-

- Flexibility: Consider options for changing premium payments, adjusting benefits, or accessing cash value.

-

- Agent credentials: Work with fee-based, fiduciary advisors, not just commission-based agents.

“Policyholders should ask for both the guaranteed and illustrated values in writing and make sure they understand the difference.”

— Birny Birnbaum, Executive Director, Center for Economic Justice (2019)

Questions to Ask Agents

-

- What are the guaranteed vs. projected returns?

-

- What are the surrender charges, and for how long do they apply?

-

- How much of my premium goes to commissions and fees?

-

- What are the loan interest rates, and what happens if I can’t repay a loan?

-

- What are the real past dividend rates, not just projections?

-

- What happens if I can’t pay premiums for a few months or years?

Frequently Asked Questions (FAQ)

Q: Are whole life insurance dividends guaranteed?

A: No. Dividends are not guaranteed; they depend on the insurer’s profits and investment performance[4].

Q: Can I lose money with whole life insurance?

A: Yes. Early surrender may result in losing much of your premium to fees and surrender charges.

Q: What happens if I borrow against my policy and can’t repay the loan?

A: Outstanding loans and interest reduce your death benefit and cash value. If loans exceed cash value, the policy can lapse, creating a tax bill[1].

Q: How do I know if a policy is a Modified Endowment Contract (MEC)?

A: Ask your agent for a written statement. MECs are subject to tax penalties on withdrawals[2].

Q: Is whole life insurance a good investment?

A: For most people, no. Returns are generally lower than stock/bond portfolios, but it can be valuable for those with permanent insurance needs or estate planning goals[4].

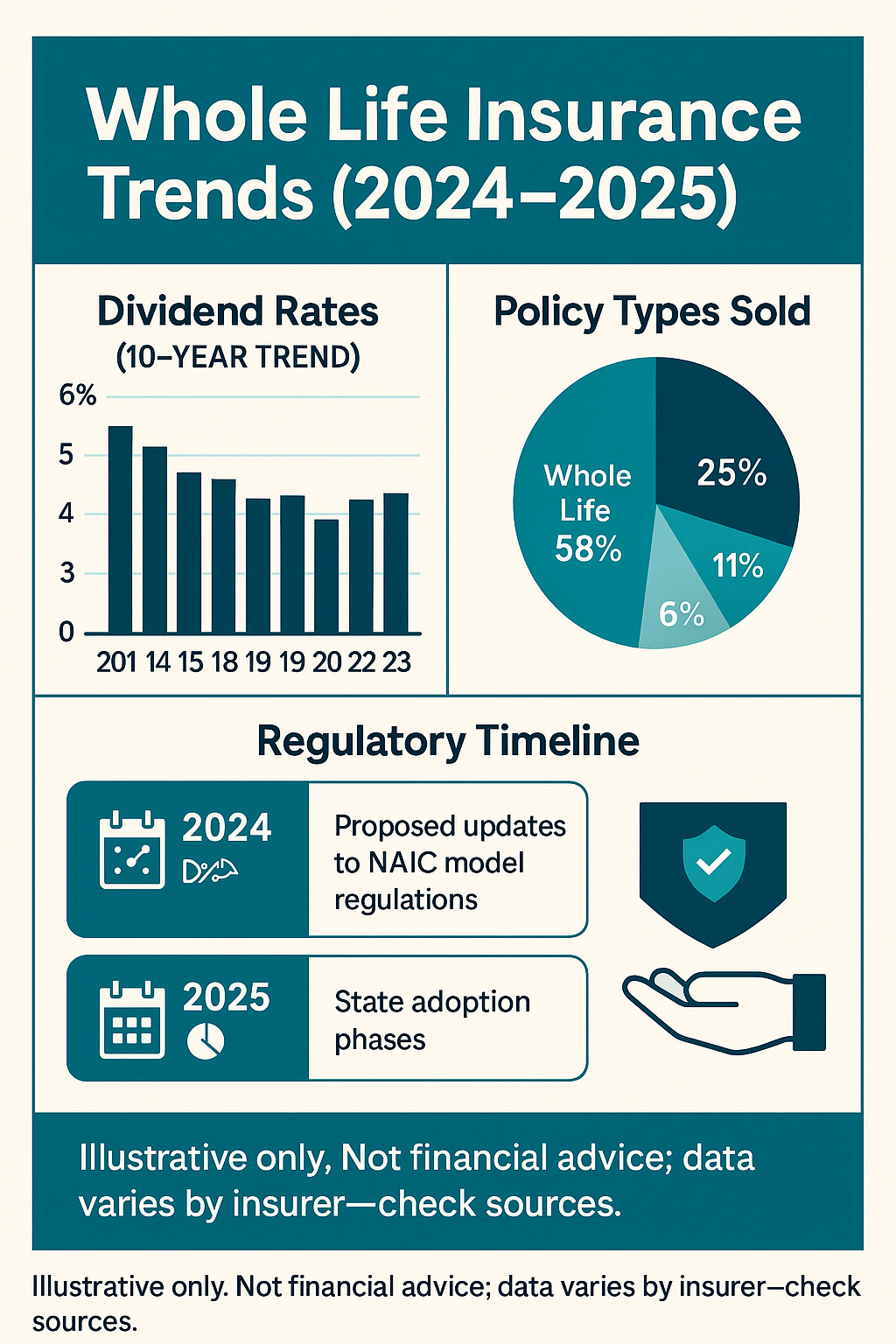

Recent Trends and Market Outlook (2024-2025)

-

- Dividend rates declining: As of 2024, most top mutual insurers are paying dividends around 5.0%–5.8%, down from over 6% a decade ago.

-

- Regulatory changes: The NAIC revised the Illustrations Model Regulation in 2023, requiring clearer disclosure of guaranteed vs. non-guaranteed elements.

-

- Consumer preferences: There’s been a shift toward term life and hybrid policies, with LIMRA reporting that 56% of new policies sold in 2024 were term life.

-

- Growth in “living benefits”: More policies offer chronic illness and accelerated death benefits.

-

- Increased scrutiny: Regulators and consumer advocates warn about overuse of whole life for young families and as investment substitutes.

Key Takeaways: – Expect lower returns than in past decades. – Compare all policy illustrations and ask for written documentation of guarantees.

Whole Life Insurance Cost & Value Calculator

Estimate Your Premiums and Cash Value Growth

Enter your age and desired coverage to see rough estimates based on 2024 data:

| Age | Coverage | Estimated Annual Premium | Cash Value After 10 Years | Projected Cash Value at Age 65 |

| 30 | $500,000 | $4,000 | $24,000 | $180,000 |

| 40 | $500,000 | $6,000 | $35,000 | $120,000 |

| 50 | $500,000 | $9,000 | $48,000 | $80,000 |

Whole Life Premium & Cash Value Estimator

Interactive, mobile‑friendly widget. Estimates only — not a quote. Actual values vary by insurer, underwriting class, state, and dividend scale.

Inputs

Results

| Projection | Total Premiums Paid | Cash Value — Guaranteed | Cash Value — w/ Dividends |

|---|---|---|---|

| Year 10 | $37,500 | $31,611 | $33,662 |

| Year 20 | $75,000 | $83,323 | $96,053 |

| Year 30 | $112,500 | $152,819 | $192,944 |

Join the Conversation: Share Your Experiences

Have you bought or considered whole life insurance?

– Share your stories, agent experiences, or questions below. – What “insider secrets” did you wish you’d known? – All comments are moderated for accuracy and privacy.

Conclusion

Whole life insurance offers unique guarantees and lifelong coverage, but it’s not a one-size-fits-all solution. High costs, complex terms, and agent incentives mean that policyholders must scrutinize every detail—from fees to dividends and loan terms. Armed with real-world examples, expert advice, and a critical eye for “insider secrets,” you can make informed decisions that align with your financial goals.