Table of Contents

- Introduction

- Key Takeaways

- What’s New in 2025: Regulatory and Market Updates

- How Indexed Universal Life Insurance (IUL) Works

- Infographic: How IULs Build Value

- Pros and Cons of IUL for US Buyers

- Who Should Buy IUL? US Buyer Personas and Scenarios

- US-Specific Tax Implications and Regulatory Considerations

- Comparison of Leading IUL Products (2025)

- Interactive IUL Calculator

- Tax-Efficient Strategies for US Buyers

- Downloadable Resources: Checklist and Summary

- Expanded FAQ for US Buyers

- How To Buy IUL in the US: Step-by-Step Guide

- Author Bio

- Conclusion

- References

Introduction

Indexed Universal Life Insurance (IUL) has become a popular solution for US buyers seeking a blend of flexible life insurance protection and the potential for cash value growth linked to stock market indexes—without the direct risk of equity investing. As regulations, product designs, and tax rules evolve into 2025, US consumers face more options and complexity than ever. This definitive guide breaks down everything you need to know about IUL as a US buyer, from real-world scenarios and tax strategies to regulatory updates, expert advice, and interactive tools.

Key Takeaways

- IUL policies offer flexible premiums, adjustable death benefits, and tax-advantaged cash value growth for US buyers.

- Cash value is linked to market indexes but not invested directly, providing both upside potential and downside protection.

- IRS tax rules and state regulations significantly impact how IUL policies work, especially regarding loans, withdrawals, and Modified Endowment Contracts (MECs).

- Recent 2025 updates introduce new index options, higher guaranteed minimum rates, and stricter compliance requirements.

- Ideal buyers include high-net-worth individuals, small business owners, and retirees seeking tax-efficient wealth transfer and supplemental income.

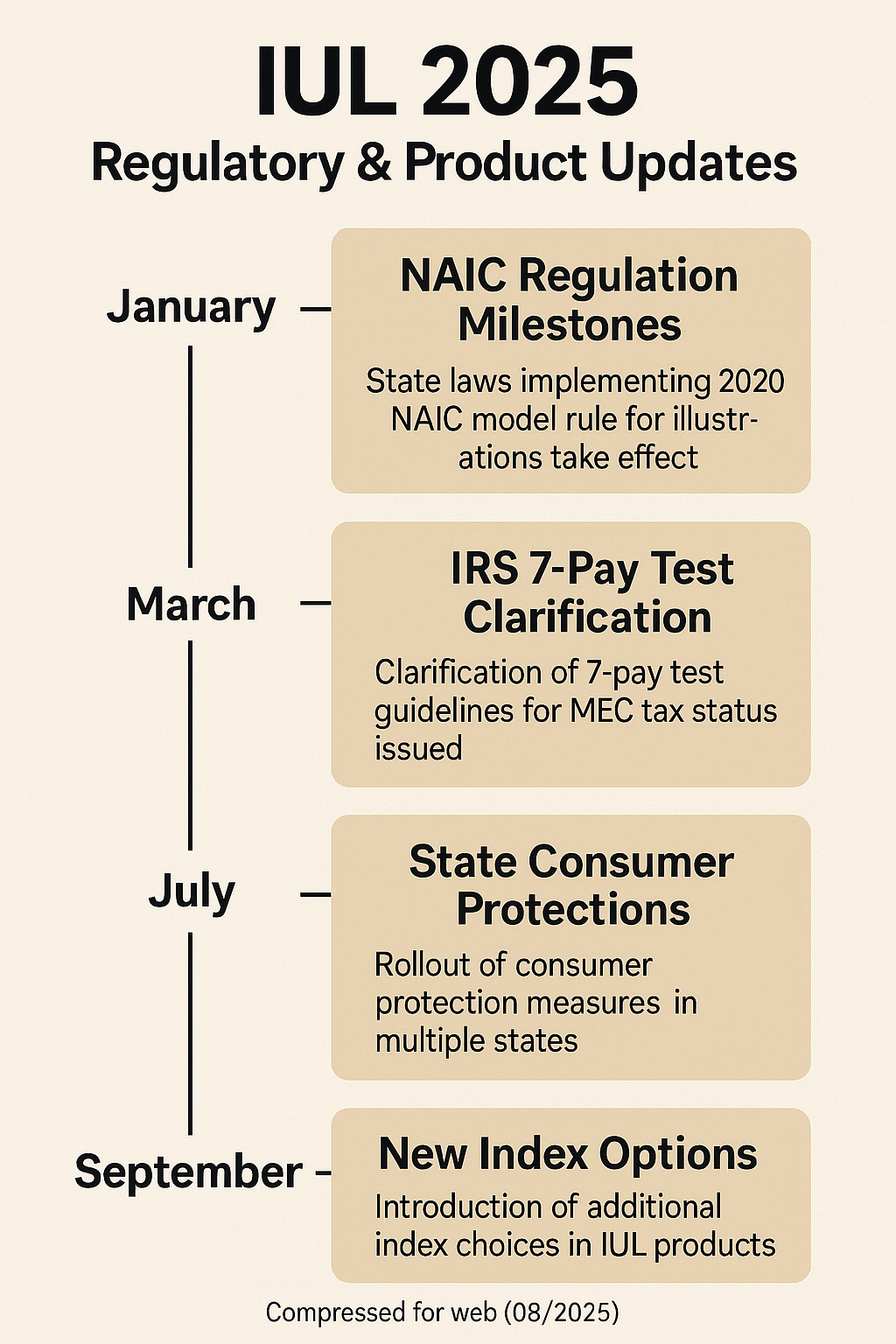

What’s New in 2025: Regulatory and Market Updates

The IUL landscape in the US continues to evolve, with several noteworthy changes for 2025:

- NAIC Model Regulation Update: The National Association of Insurance Commissioners (NAIC) updated model regulations, requiring clearer disclosures on index performance assumptions and illustrating lower maximum illustrated rates.

- IRS Guidance: The IRS issued new clarifications on the 7-pay test for Modified Endowment Contracts, with stricter monitoring of cumulative premium payments.

- State-Level Changes: Several states, including California and New York, added consumer protection measures—mandating simplified disclosures and enhanced suitability analysis for buyers over age 60.

- Market Data: According to LIMRA’s 2024 US Individual Life Insurance Sales Report, IUL sales grew by 17% year-over-year in 2024, reflecting rising demand for flexible and tax-efficient permanent life insurance[1].

- Index Options: New volatility-controlled index options are now standard in leading IUL products, offering more consistent returns in unpredictable markets.

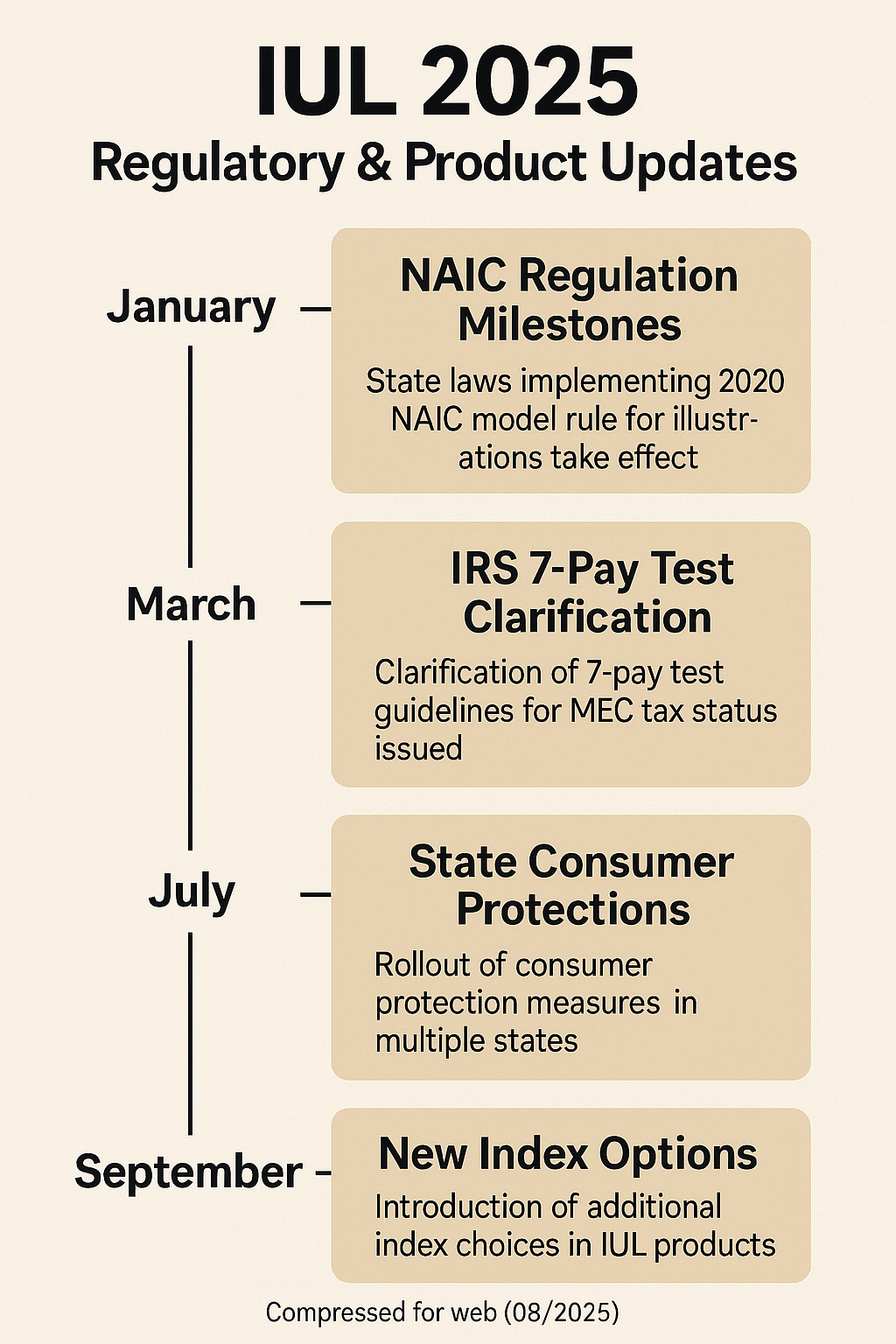

How Indexed Universal Life Insurance (IUL) Works

IUL is a type of permanent life insurance with a cash value component that earns interest based on the performance of a chosen stock market index (such as the S&P 500), subject to policy caps and floors. Unlike variable universal life, the cash value is not directly invested in equities, reducing risk.

Premium Flexibility and Adjustable Death Benefits

IUL allows flexible premium payments:

– You can pay more than the minimum to build cash value faster or pay just enough to keep the policy in force. – Death benefits can often be increased (with underwriting) or decreased to fit changing needs.

Index Options and Performance

- The cash value grows based on a formula tied to one or more indexes.

- Most IUL policies offer a floor (0–1%), protecting against market losses, and a cap (typically 8–12%) on upside gains.

- Some policies now feature volatility-controlled indexes for smoother returns.

According to the [Society of Actuaries][2], the average annual credited interest rate on IUL cash values ranged from 5.2% to 7.1% between 2015 and 2024, depending on cap rates and index performance (2024).

Cash Value Accumulation and Minimum Interest Guarantees

- The cash value is tax-deferred as it grows, and can be accessed via loans or withdrawals (see tax section below)[1][2][4].

- Minimum interest guarantees (often 0–1%) ensure your cash value doesn’t decrease in a down market, except for the impact of policy fees.

Pros and Cons of IUL for US Buyers

| Pros | Cons |

| Tax-deferred cash value growth | Complex structure and higher fees |

| Flexible premiums and adjustable death benefit | Caps and participation rates limit upside |

| Downside protection with minimum guarantees | Returns depend on index performance and policy fees |

| Tax-free loans and withdrawals (if structured) | Policy lapse risk if not properly funded |

| No contribution limits (unlike IRAs/401(k)s) | May not be suitable for short-term needs |

| Death benefit generally tax-free to beneficiaries | Potential MEC status if overfunded |

“Indexed universal life insurance offers the flexibility and upside potential many Americans want, but it’s crucial to understand the fees, the moving parts, and the long-term commitment required.”

— Mark Maurer, CFP, President & CEO, LLIS (2023)[3]

Who Should Buy IUL? US Buyer Personas and Scenarios

Scenario 1: High-Net-Worth Individual

Profile: Age 45, earns $400,000/year, maxes out 401(k) and IRA, seeks tax-advantaged wealth transfer.

Recommendation: Overfund an IUL for additional tax-deferred growth with no IRS contribution limits. Use policy loans for tax-free supplemental retirement income. Set up the policy with a focus on legacy planning.

Outcome: Beneficiaries receive a tax-free death benefit. Owner accesses cash via policy loans in retirement, supplementing other tax-advantaged income sources.

Scenario 2: Small Business Owner

Profile: Age 38, owns a successful LLC, irregular income, needs flexible premiums and business succession planning.

Recommendation: Use IUL to provide life insurance protection for family and business continuity. Overfund in profitable years, reduce premiums in lean years. Set up a buy-sell agreement funded with the policy.

Outcome: Cash value serves as an emergency fund or can be borrowed against for business opportunities. Death benefit secures business transfer to partner or heirs.

Scenario 3: Retiree Seeking Tax-Advantaged Income

Profile: Age 62, nearing retirement, seeks safe, tax-efficient income streams.

Recommendation: Fund IUL at ages 55–62, then take policy loans in retirement to supplement Social Security and pensions without increasing taxable income.

Outcome: Maintains tax bracket, avoids required minimum distributions (unlike IRAs), and leaves a tax-free death benefit to heirs.

“For clients concerned about future tax rates and legacy planning, IUL offers a unique combination of growth potential and flexibility.”

— David McKnight, Author and Retirement Consultant (2021)[4]

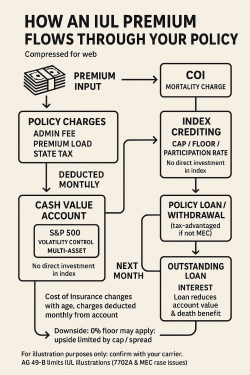

US-Specific Tax Implications and Regulatory Considerations

The IRS and state regulations play a major role in how IUL policies are taxed and structured for US buyers.

IRS Rules and Modified Endowment Contracts

- 7-Pay Test: If cumulative premiums paid exceed the amount needed to pay up the policy in seven years, the policy becomes a Modified Endowment Contract (MEC), losing tax-free loan advantages[2].

- Tax-Deferred Growth: Cash value grows tax-deferred; no annual reporting required[1][2][4].

- Withdrawals: Withdrawals are tax-free up to your basis (total premiums paid). Gains above basis are taxed as ordinary income[1][2].

- Policy Loans: Loans are generally tax-free as long as the policy is in force. If the policy lapses or is surrendered with loans outstanding, the borrowed amount above basis becomes taxable[1][2][4].

- Death Benefit: Paid to beneficiaries income tax-free, except for certain large estate situations where estate tax may apply[2][3].

State-Level Regulations

- States like New York and California require additional consumer disclosures and suitability assessments for buyers over age 60 as of 2025.

- Many states follow NAIC model guidelines but may have their own insurance department compliance rules.

Tax Treatment of Cash Value and Death Benefits

According to [SmartAsset][1]: – “IULs accumulate cash value on a tax-deferred basis, meaning you don’t pay taxes on the growth each year. Withdrawals from the policy’s cash value are tax-free up to the amount of premiums paid into the policy… Loans taken against the policy’s cash value are generally tax-free, provided the policy remains in force.” (2024)

Comparison of Leading IUL Products (2025)

| Company | Product Name | Index Options | Cap Rate (2025) | Min. Guarantee | Policy Fees (est.) | Notable Features |

| Nationwide | New Heights IUL | S&P 500, Multi-Index | 9.5% | 1% | Med-High | Volatility control, strong caps |

| Pacific Life | Pacific Horizon IUL | S&P 500, MSCI | 8.2% | 0.75% | Medium | Low-cost loan options |

| Lincoln Financial | WealthAdvantage IUL | S&P 500, NASDAQ | 9.0% | 1% | Medium | High flexibility, living benefits |

| Prudential | FlexGuard IUL | S&P 500, Custom | 8.7% | 1% | Medium | Indexed loan feature, strong support |

*Data from 2025 product disclosures and LIMRA market survey (2025)[1][5].

Tax-Efficient Strategies for US Buyers

- Overfund IUL up to but not beyond MEC limits to maximize cash value and maintain tax-free loan access[4].

- Leverage policy loans in retirement for tax-free income, supplementing other taxable sources and potentially reducing Medicare IRMAA surcharges.

- Use IUL in estate planning: Pass a tax-free death benefit to heirs, potentially outside the probate process and free from income tax[3].

“The tax advantages of IUL—if managed properly—can offer true financial diversification for retirement and estate planning.”

— Wade Pfau, PhD, Professor of Retirement Income, The American College of Financial Services (2022)[5]

Downloadable Resources: Checklist and Summary

- Downloadable US Buyer’s Checklist (PDF)

- Key decision points

- Questions to ask your advisor

- Documentation needed

- Policy illustration checklist

- Printable Summary of Key IUL Features

Expanded FAQ for US Buyers

Q: Is IUL right for everyone?

A: No. IUL is best for buyers seeking long-term life insurance, flexibility, and tax-advantaged growth. Short-term, risk-averse, or fee-sensitive buyers may prefer simpler products like whole life or term insurance.

Q: What happens if I stop paying premiums?

A: The policy may lapse if cash value isn’t sufficient to cover costs. Many policies allow reduced paid-up insurance or grace periods.

Q: Can I change my index allocation?

A: Most IULs allow annual changes to index options, but changes may impact credited interest rates.

Q: What is the maximum loan amount?

A: Typically, up to 90% of cash value, but borrowing too much can jeopardize policy performance.

Q: How do I avoid MEC status?

A: Work closely with your advisor to monitor funding and stay within IRS 7-pay limits.

How To Buy IUL in the US: Step-by-Step Guide

- Assess Needs: Determine coverage, premium flexibility, and long-term goals.

- Compare Policies: Review features, caps, floors, and fees from multiple carriers.

- Request Illustrations: Get detailed projections based on realistic index returns.

- Consult Tax and Insurance Experts: Ensure compliance with IRS and state rules.

- Complete Application: Medical underwriting may apply.

- Fund Policy: Avoid overfunding to prevent MEC status.

- Review Annually: Monitor index performance, fees, and cash value growth.

Author Bio

William Noel, is a licensed US life insurance expert with several years of experience advising clients on advanced insurance planning.

Conclusion

Indexed Universal Life Insurance offers US buyers a uniquely flexible way to combine permanent life insurance protection with the growth potential of the stock market—without direct investment risk. As 2025 brings new regulatory updates and product innovations, understanding IRS rules, state regulations, and the nuances of cash value growth is critical. By leveraging expert insights, interactive tools, and scenario-based recommendations, you can make an informed decision that fits your long-term financial goals.

References

[1]: SmartAsset. “How Taxes for Indexed Universal Life (IUL) Insurance Work” (2024)

[2]: Guardian Life. “What is Indexed Universal Life Insurance (IUL)?” (2024)

[3]: Mark Maurer, CFP, President & CEO, LLIS. Quoted in Kiplinger (2023)

[4]: David McKnight, Author and Retirement Consultant. Quoted in U.S. News & World Report (2021)

[5]: Wade Pfau, PhD, Professor of Retirement Income, The American College of Financial Services. Quoted in Forbes (2022)